How to Use Your HSA/FSA Dollars on Purchases

At Medpaid, we make it easy to use your HSA or FSA dollars — whether you pay directly at checkout or submit for reimbursement later.

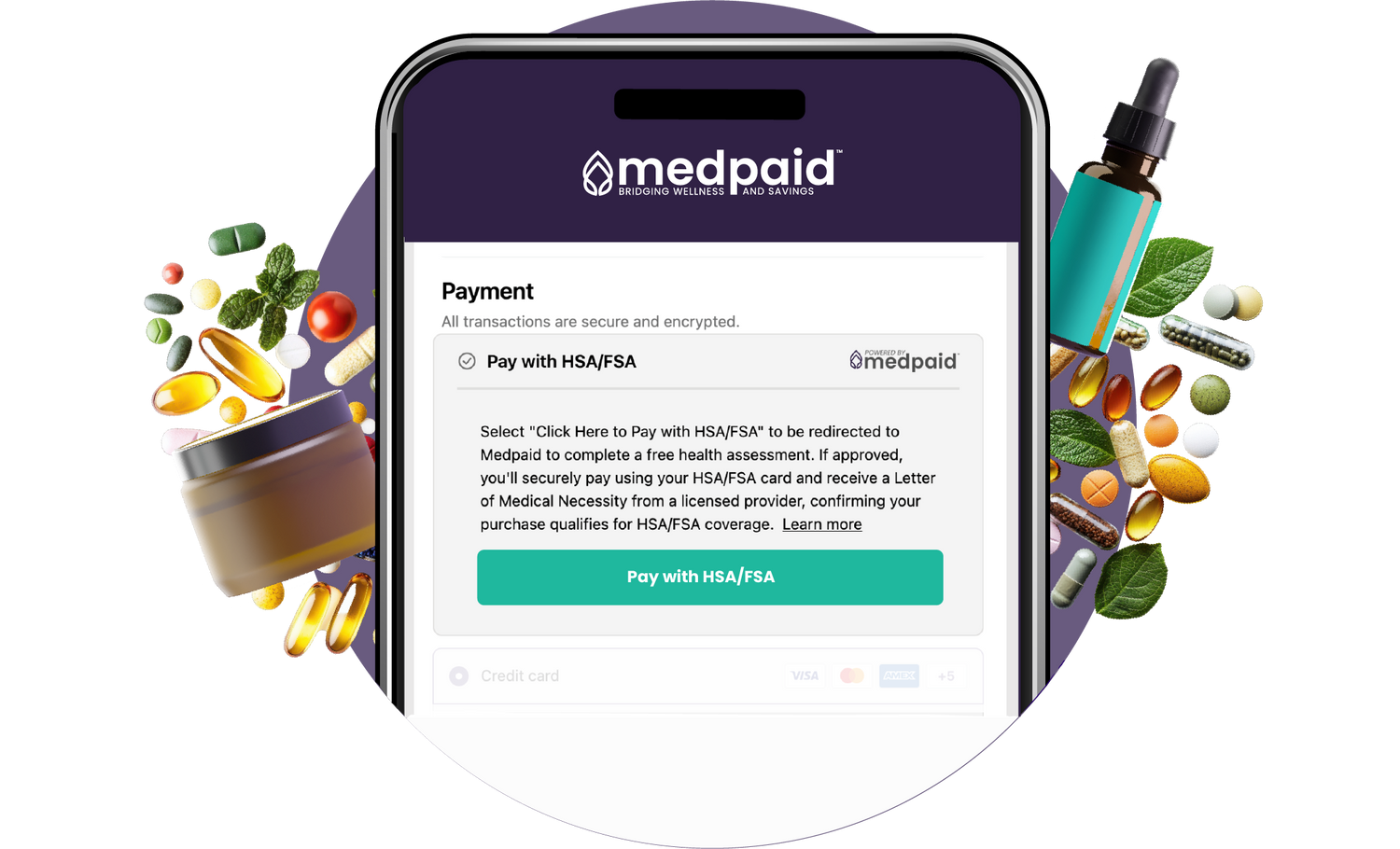

Pay With Your HSA/FSA Card

- Select Pay with HSA/FSA as your payment method during checkout.

- Take a 1 minute online health assessment to qualify for a Letter of Medical Necessity (Gives permission to use HSA/FSA funds on purchases of product(s) in your cart for up to 12 months).

- Enter your HSA/FSA card information just like a regular credit or debit card.

Fastest and easiest option

Pay directly with pre-tax dollars

Letter of Medical Necessity

Pay with HSA/FSA Card

Submit for Reimbursement

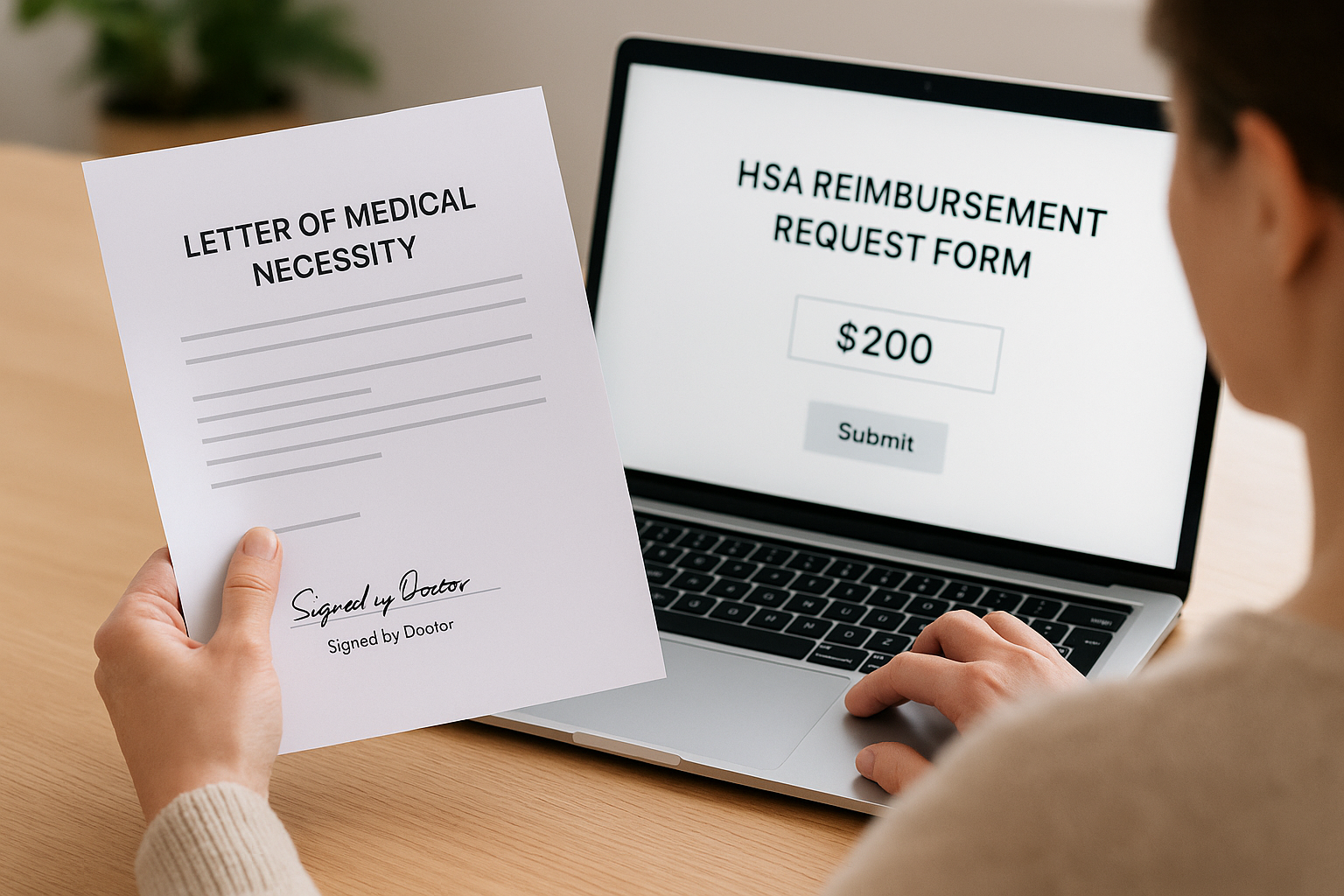

Don’t have your HSA/FSA card handy? Or not enough funds immediately available? You can still get reimbursed now, or submit for reimbursement up to 12 months after purchase.

- Select "Pay with HSA/FSA"

- Complete 1 minute online health assessment

- Checkout with regular card on Medpaid's payment form step

- Submit your receipt & LMN to your HSA/FSA provider for reimbursement.

Use your regular card now, get reimbursed up to 12 months later

Perfect if your HSA/FSA balance is low or your card isn’t available

Get reimbursed for up to 12 months of purchases of approved products/services.

How Your Letter of Medical Necessity (LMN) Qualifies Purchases with HSA/FSA Dollars

Medpaid makes it simple to get approved purchases reimbursed for up to 12 months. Once expired, renew your Letter of Medical Necessity right at checkout. Just shop anywhere Medpaid is offered, complete your quick online health assessment during checkout, and once it’s approved, you’ll be eligible for another 12 months of reimbursements.

Understand Your LMN

You should have received a Letter of Medical Necessity (LMN) from Medpaid. This LMN verifies that your purchase helps prevent, treat, or alleviate a disease, allowing you to use tax-free HSA/FSA dollars. Your LMN is valid for 12 months from the issuance date.

Keep a copy of your LMN in your tax records to verfiy qualified HSA/FSA expenses.

Identify Your HSA/FSA Administrator

If you are unsure who your HSA/FSA administrator is, consult with your employer’s HR department.

Log into Your HSA/FSA Administrator’s Online Portal

Only needed if you choose reimbursement vs HSA/FSA card purchase. Use your credentials to access your HSA/FSA administrator’s online platform. If you don’t have an account, you will need to create one. At the end of this document, you will find links and specific instructions for popular HSA/FSA administrators.

Locate the ‘Reimbursement’ or ‘Claims’ Section

Then, navigate to the reimbursement or claims section of your HSA/FSA online platform.

Submit Your LMN and Receipt

Only needed if you choose reimbursement vs HSA/FSA card purchase. Upload the following essential documents: Your LMN from Medpaid and the receipt for the item or service you purchased based on the Medpaid health survey.

Await Confirmation

Only needed if you choose reimbursement vs HSA/FSA card purchase. It typically takes from a few days to a few weeks for the administrator to process your claim. The reimbursement amount will be deposited directly into your designated account.

Repeat for Future Receipts

Only needed if you choose reimbursement vs HSA/FSA card purchase. Use the same LMN to claim reimbursement for future receipts, as long as the LMN remains valid (within 12 months of issuance), and the items are eligible via the LMN.

Reimbursement Steps for Major HSA/FSA Administrators

Frequently Asked Questions

What is Medpaid?

What is Medpaid?

Medpaid partners with health and wellness brands to enable qualified customers to use HSA/FSA funds on health and wellness purchases. Medpaid collaborates with a network of medical practitioners who can issue Letters of Medical Necessity to qualifying customers, saving them money on health and wellness purchases.

What is a Letter of Medical Necessity, and how is this compliant?

What is a Letter of Medical Necessity, and how is this compliant?

Your Medpaid Letter of Medical Necessity (LMN) qualifies your wellness purchases as medical expenses, similar to a doctor’s visit or pharmaceutical product. The US faces a chronic disease epidemic, with numerous studies showing that food and exercise are effective in preventing and reversing diseases. Exercise qualifies as a medical expense with an LMN. Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness and are substantiated by a doctor. Your Medpaid LMN satisfies all IRS requirements to make your wellness expenses fully reimbursable. Read the full details of our policy in our Terms of Service, and email info@medpaid.com if you have any questions or need assistance.

What are HSA and FSA accounts?

What are HSA and FSA accounts?

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-free accounts used to pay for qualified medical expenses. These accounts are usually set up and managed by an HSA or FSA administrator, accessible through your employer (ask your HR department!). There are key differences between HSA and FSA accounts, as outlined by Optum in this article.

How does using my HSA/FSA save me money?

How does using my HSA/FSA save me money?

HSA/FSA accounts allow you to use pretax money for medical expenses, increasing your purchasing power. You can contribute up to $4,150 to your HSA per year, saving between $1,000 and $2,000 depending on your state and tax rate.

How long does it take to receive HSA/FSA reimbursement?

How long does it take to receive HSA/FSA reimbursement?

Most HSA/FSA administrators process claims within 7-10 days when you submit your receipt along with a Letter of Medical Necessity. Reimbursement timing varies by administrator. We recommend using direct HSA/FSA card payments to skip the reimbursement process and save instantly.

How do I report this on my taxes?

How do I report this on my taxes?

For HSAs, there are 3 associated tax forms: IRS Form 1099-SA, 5498-SA, and IRS Form 8889. Use the information from your 1099-SA form, available from your HSA administrator during tax season, to fill out IRS tax form 8889. Only form 8889 needs to be submitted with your taxes. Ensure you keep copies of all submitted documents for your records.

If you encounter any issues, contact your HSA/FSA administrator’s customer service.

If written, your Letter of Medical Necessity (LMN) represents your provider’s clinical opinion that an exercise or food program should be used to prevent disease. This LMN can be used to purchase defined items with your HSA/FSA.

This LMN is a general health guidance and does not constitute the practice of medicine or establish a duty of care between you and your provider. This service is not a replacement for a Primary Care Provider.